“To arrive at the $1 trillion economic destination, we believe that we must address the capital adequacy of our banks,” the President said.

The Presidency has backed plan by the Central Bank of Nigeria (CBN) to increase the capital base of deposit money banks in the country.

President Bola Tinubu, in a goodwill message at the 40th anniversary of The Guardian Newspapers in Lagos on Tuesday, said bank recapitalisation is crucial to achieving a $1 trillion economy.

The President’s Special Adviser on Information and Strategy, Bayo Onanuga, represented his principal at the event.

“Amidst the general lull in global economy, our ambition to attain a $1 trillion economy appears daunting. But we believe it is achievable, with God on our side and our collective determination. This explains why the Vice President and I have been on the road, trying to attract huge investments in various facets of our economy: agriculture, oil and gas, renewable energy and others.

“To arrive at the $1 trillion economic destination, we believe that we must address the capital adequacy of our banks that will provide the fuel for the journey,” the President stated.

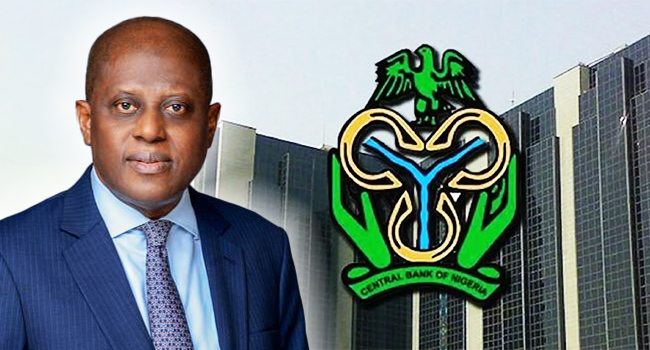

Last Friday, CBN Governor, Olayemi Cardoso, said commercial banks in the country would be directed to increase their capital base.

He said commercial banks currently don’t sufficient capital relative to the finance system needs in servicing a $1trn economy.

He said, “Considering the policy imperatives and the projected economic growth, it is crucial for us to evaluate the adequacy of our banking industry to serve the envisioned larger economy.

“It is not just about the stability of the financial system at the moment as we have already established at the current assessment to show stability.

“However, we need to ask ourselves: will Nigerian banks have sufficient capital relative to the finance system needs in servicing a $1trn economy in the near future? In my opinion, the answer is ‘No’ unless the we take action.

“Therefore, we must make difficult decisions regarding capital adequacy. As a first step, the Central Bank will be directing banks to increase their capital.”

The last time the CBN increased capital base for banks was in 2005 when current Anambra State Governor, Charles Soludo, was the apex bank chief. Capital base was raised from N2bn to N25bn.